Are you searching for an alternative investments for everyday investors? Then this is the right platform. This is because this guide will explain to you various wealth opportunities. There are numerous alternative investments, including bonds, stocks, and mutual funds. But these investments are limited to certain people.

Different accredited investors can easily benefit from these profitable assets, and these are not available to all people. Please get to know the complete details regarding accredited investors and alternative investments for them.

Who is an Accredited Investor?

It is very important to understand what qualifies you for being an accredited investor. According to the SEC guidelines, a person is considered accredited if they earn more than $200000 annually. He is also considered accredited if he has a net worth of more than $1 million. Along with this, he should hold specific financial licences, including Series 7, 65, or 82.

If any individual meets all these requirements, then he is considered to be an accredited investor, and they can easily choose the alternative investment options. This is because alternative investments have more risk as compared to other investments, and they are less regulated. So, the regulators only consider the accredited investors who have complete experience and knowledge to handle them.

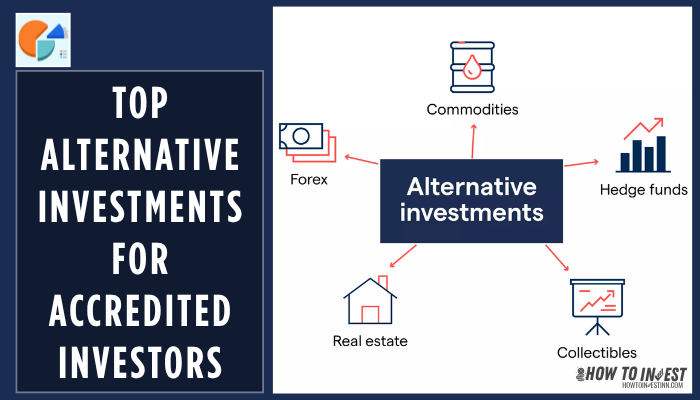

Alternative Investments Opportunities for Accredited Investors

Here are some of the alternative investment opportunities for the accredited investors. These opportunities provide you with strong diversification and high returns. Get to know them and then consider if you are an accredited investor.

- Hedge Funds:

Hedge funds utilize numerous strategies, including arbitrage derivatives, for generating alpha. These are helpful for performing well in the investment market. But they comprise of high fee structure, and their liquidity is also limited. These funds often require a large minimum, so they are much preferable by the accredited investors.

- Private Credit:

The private credit is also known as direct lending. In this, the investors provide money as a loan to various businesses in exchange for attractive interest payments. It has a very high potential, and income is also guaranteed. But the liquidity is lower in private credit, and it is exposed to various risks and challenges.

- Commodities and Natural Resources:

There are various commodities and natural resources, including agriculture, gold, oil, etc. These commodities are a big asset. You can easily invest in them as well. This is because these assets are helpful in standing against the inflation risk. Moreover, they also provide you with inflation protection and are considered a physical asset backing.

But on the other hand, they are also volatile because of the market fluctuations. They also comprise storage costs. If you are an accredited investor, then you can easily consider it as a long-term investment option because it can stabilize a stock-heavy portfolio as well.

- Cryptocurrency and Digital Assets:

The cryptocurrencies, including Bitcoin and Ethereum, are much preferable by the investors. But the accredited investors can easily access the funds. If they invest in blockchain technology, tokenized assets, or decentralized financing, it is very helpful for them to get a high return on their investment.

Moreover, it will also be beneficial to have decentralized access. But along with its benefits, there are some challenges associated with cryptocurrency as well. There are various regulatory uncertainties and market volatility which can be challenging for investors.

Benefits of Alternative Investments

Here are some of the benefits associated with the use of alternative investments for accredited investors. You can easily consider these investment options because of the following compelling reasons:

- Portfolio Diversification:

This alternative investment will help investors diversify their portfolios. This will reduce the risk by diversifying your investment options.

- High Returns:

The alternative investment option provides you with a high return on your investment. Also, many alternative investment options have performed outstanding in the public markets.

- Access to Opportunities:

Investing in alternative investment options will be helpful for accessing the unique opportunities. So, the investors will also get a good benefit in return.

How to Access Alternative Investments?

There are numerous ways in which accredited investors can easily access alternative investments. Get to know these methods if you are an accredited investor:

- Private Placement Platforms:

There are many private platforms, including Fundrise, Yieldstreet, etc., which help you in getting numerous alternative investment options.

- Wealth Advisors:

Numerous private banks also provide you with alternative funds, which are helpful for investors to get a good return on their investment.

- Direct Investment:

You can also choose collectables or real estate investment opportunities to maximized revenue in a certain period.

- Special Funds:

If you are an accredited investor, then you can easily access the specialized funds as well. These special funds include crypto points and private equity vehicles. This helps in providing you with a good investment opportunity.

FAQs

1. What is the qualification required for becoming an accredited investor?

Ans. You need to become very wealthy and meet the net worth threshold in order to become an accredited investor.

2. How can I know about the risk of any alternative investment?

Ans. You can monitor the performance, liquidity, fees, experience, and the conditions of the market of that specific alternative investment option.

3. Are there any tax implications on the alternative investments?

Ans. Yes, numerous alternative investments have unique tax structures. So, you must consult a tax advisor before investing in any asset.

Wrapping Up

If you have met the criteria of becoming an accredited investor, then you can easily invest in alternative investments. There are numerous alternative investment options that provide you with exclusive opportunities. It will help in building your portfolio. Moreover, it will also be helpful in providing a maximized revenue on your investment.